In our previous blog in this two-part series, we uncovered why France would be a good option for a Gymshark European market expansion and key considerations the brand could take for a successful expansion. Today, we’ll assess which Klepierre retail centres in these high-potential French cities would benefit most from housing a Gymshark in their centre as part of a hypothetical Gymshark French market expansion.

How Retail Footprint Europe could help Klepierre understand which retail centres would benefit from a Gymshark store

While there are many centres in France that would be suitable to bring Gymshark into based on the best shopper profile correlation in a hypothetical Gymshark market expansion, Retail Footprint Europe, CACI’s machine learning catchment model defining catchments for thousands of destinations, has helped determine three particular Klepierre centres that would ultimately become a good fit. With key Gymshark shoppers comprising Affluent Singles & Couples, Affluent Young Families, Middle Income Singles and Student Life profiles from Acorn, CACI’s geodemographic segmentation, these insights were cross-referenced against Retail Footprint Europe insights to equip the business with granular insights and tangible actions to help landlords deduce which centres would work and why.

Finally, to gain insight into actual footfall and compare actual versus expected footfall against these Gymshark profiles and conclude which centres presented opportunities to attract more of Gymshark’s core shoppers, Mobility Data was leveraged.

Saint-Lazare Klepierre in Paris

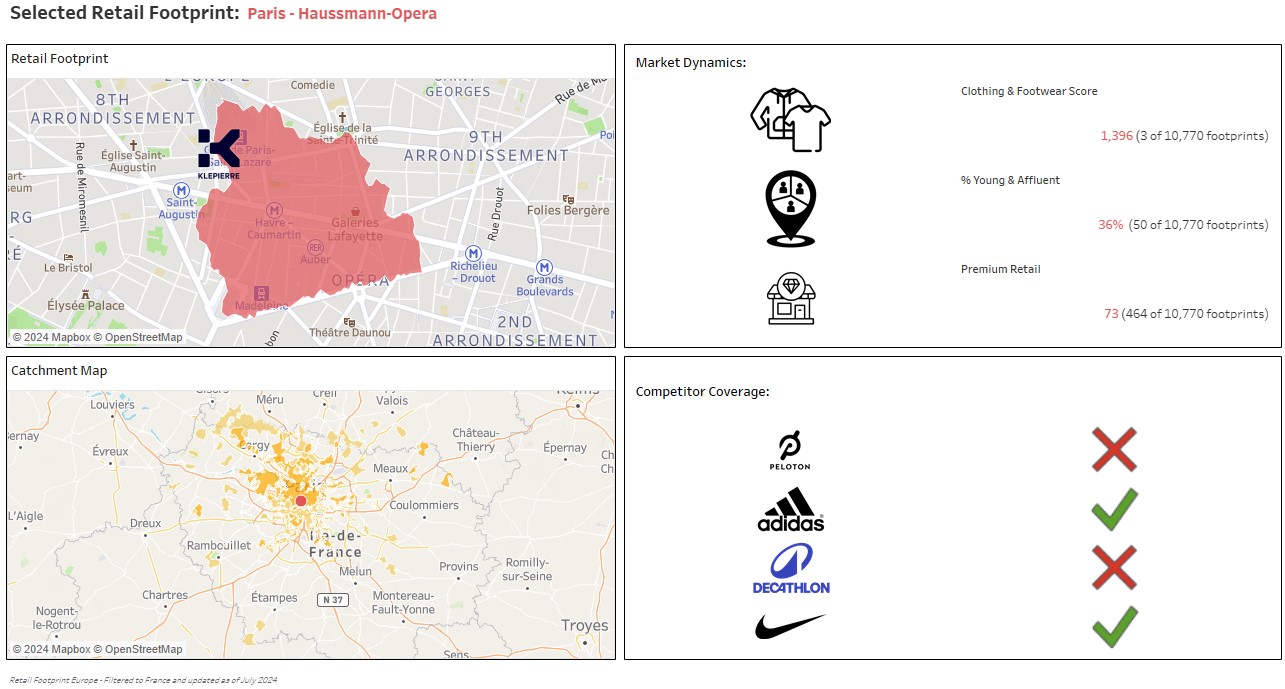

According to our findings, one of the Klepierre centres that would benefit most from the presence of a Gymshark would be the Saint-Lazare in the Haussmann-Opera retail area. This centre is expected to attract the highest potential of Gymshark’s core shoppers at 43%. Saint-Lazare also has the most affluent profile at an expected 34%. However, the area is home to lower levels of Student Life profiles, with just 1% expected to visit the centre.

Paris houses a strong proportion of premium retailers that align with Gymshark’s offering, with this particular Klepierre centre featuring a blend of competitors and complementary retailers, already housing the likes of Adidas and Nike, which both have similar offerings to Gymshark. Its shopper demographic also lends itself to those who are likely to either be existing Gymshark customers or will become ones once the brand enters the physical market.

Retail Footprint Europe insights for Saint-Lazare Klepierre

The Haussman-Opera retail area holds the third largest clothing and footwear store presence across France, with many premium and broader retailers and a higher percentage of affluent and younger consumers. Our findings also show that people travel well outside of Paris into this area to shop, making it a fantastic location to quickly grow brand reach and exposure.

Acorn insights for Saint-Lazare Klepierre

Saint-Lazare appears to perform the most in line with Gymshark’s core shoppers, with 44% originating from its expected profile according to our Mobility Data findings. This data provides insight on actual footfall and illustrates the comparison between actual and expected versus the Gymshark profile to understand if a centre had an opportunity to attract more of Gymshark’s core shoppers.

As a more premium brand, Gymshark achieves particularly high indexes for affluent consumers, but also performs well with aspiring, younger and urban consumers within the Gymshark core shopper profiles outlined by Acorn. Compared to fellow sportswear brand, Adidas, the brand has a much broader appeal and can perform in-line with their average consumers, while Gymshark performs significantly weaker in these segments.

Centre Commercial Centre Bourse Klepierre in Marseille

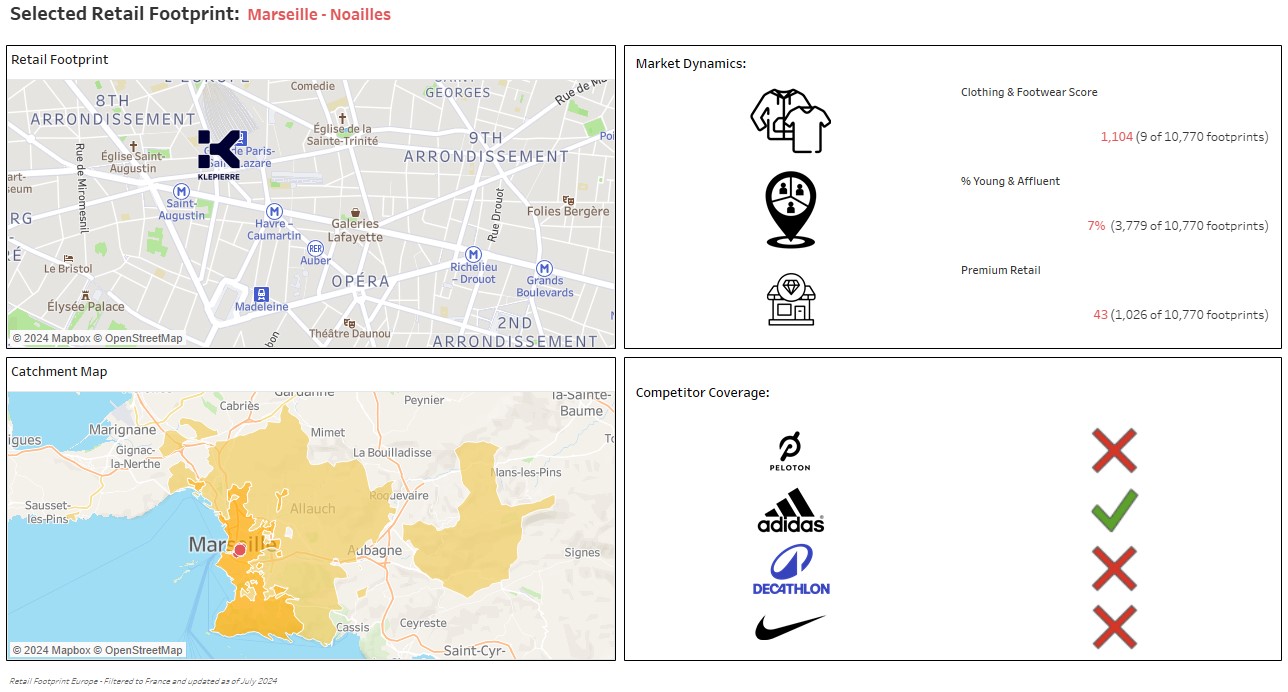

Retail Footprint Europe insights for Centre Commercial Centre Bourse Klepierre

Centre Commercial Centre Bourse would be a strong runner up to Paris thanks to its high-performing site in terms of its Clothing and Footwear Score and its high proportion of premium retailers that align with Gymshark’s offering, according to our Retail Footprint Europe findings. However, this centre has a rather low proportion of a young and affluent shopper demographic compared to Saint-Lazare in Paris, which could see the brand running the risk of not attracting the right shoppers upon opening.

Acorn insights for Centre Commercial Centre Bourse Klepierre

Another defining factor behind Centre Commercial Centre Bourse being a suitable location for a French market expansion is due to the city’s likelihood of having the highest proportion of Affluent Young Families (15%) compared to the other locations. According to Acorn, Centre Commercial Centre Bourse in particular attracts 36% of Gymshark’s core shoppers.

Mobility Data insights for Centre Commercial Centre Bourse Klepierre

Marseille sees a 14pp higher proportion of footfall from Gymshark’s shoppers than expected, driven by the centre attracting significantly more Affluent Singles and Couples than expected, according to Mobility Data findings. Centre Commercial Centre Bourse highly reflects Gymshark’s core shoppers (both in expected and actual footfall) and has strong proportions across the different core shopper groups, while Paris is much more concentrated on a singular Affluent group.

This centre ranks 9th out of over 10,000 retail centres for its Clothing & Footwear Score and has a strong premium retail score, even higher than that of Paris. Marseille also only has one competitor in its centre, meaning the addition of another sportswear brand wouldn’t saturate the market, but shows there is demand for this category in the area.

Les Passages Pasteur Klepierre in Besancon

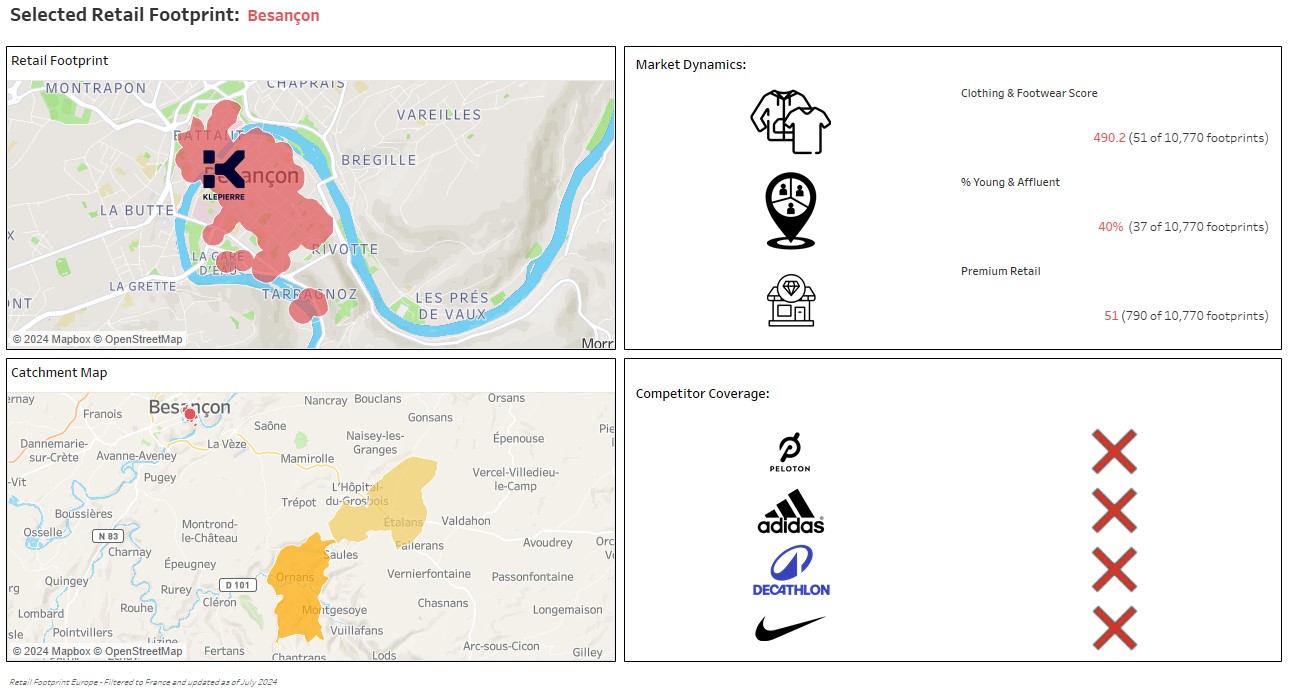

Retail Footprint Europe insights for Les Passages Pasteur Klepierre

Surprisingly, despite this smaller size of this city and inevitably lesser likelihood of Gymshark opening here, it is actually home to a high level of one of Gymshark’s core shopper demographics, Student Life, as seen in our Retail Footprint Europe data. As with Centre Commercial Centre Bourse in Marseilles, Les Passages Pasteur has a strong Clothing and Footwear offering, a substantial percentage of which are classed as premium retail. While Besancon doesn’t have any direct competitor or complimentary brands, this could be navigated with the help of clever marketing strategies.

Acorn insights for Les Passages Pasteur Klepierre

Les Passages Pasteur has a much younger profile that comprises 31% of Gymshark’s core shoppers, with 12% of its catchment expected to be Student Life, based on findings from Acorn. Unlike Centre Commercial Centre Bourse, Les Passages Pasteur has a high percentage of young and affluent shoppers (even higher than Paris), which would ensure that Gymshark was opening to a shopper demographic most likely to shop with the brand. However, the city has the least affluent profile out of the three.

Mobility Data insights for Les Passages Pasteur Klepierre

Les Passages Pasteur appears to attract the most significant amount of Gymshark’s shoppers in real footfall, with 53% of its actual footfall being from Gymshark core shoppers, as seen in our Mobility Data findings. This is because the centre is significantly over-achieving in attracting Student Life (+21pp versus expectation), showing the centre resonates very well with younger shoppers.

Using the data, which Klepierre centre would best perform in France?

With the aforementioned data to consider, the strongest contender for a successful French market expansion for Gymshark would likely come from Centre Commercial Centre Bourse Klepierre. This is due to its strong representation of Gymshark’s core shoppers, both in expected and actual footfall, as well as the proportions across the different core shopper groups compared to the other two cities and centres being more concentrated on a singular group (e.g. Affluent groups in Paris and Student Life in Besancon). With only one competitor in the Centre Commercial Centre Bourse Klepierre, the addition of another sportswear brand won’t oversaturate the market. Instead, it’d reiterate the demand for this category in the area.