Most impactful food-to-go transaction trends into 2024

With the continuing trend of hybrid work within worker hubs, consumers’ food-to-go spending in quick service restaurants (QSRs) remains concentrated on some days and displaced on others. Consumers’ wallets also continue to face an ongoing squeeze, resulting in pressures on day-to-day convenience spend.

So, what transactional trends are being observed across different demographic groups, geographies and price-points as these trends continue? What impact do these trends have on operators’ future openings strategies and overall performance?

Food & beverage have become increasingly prominent on High Streets

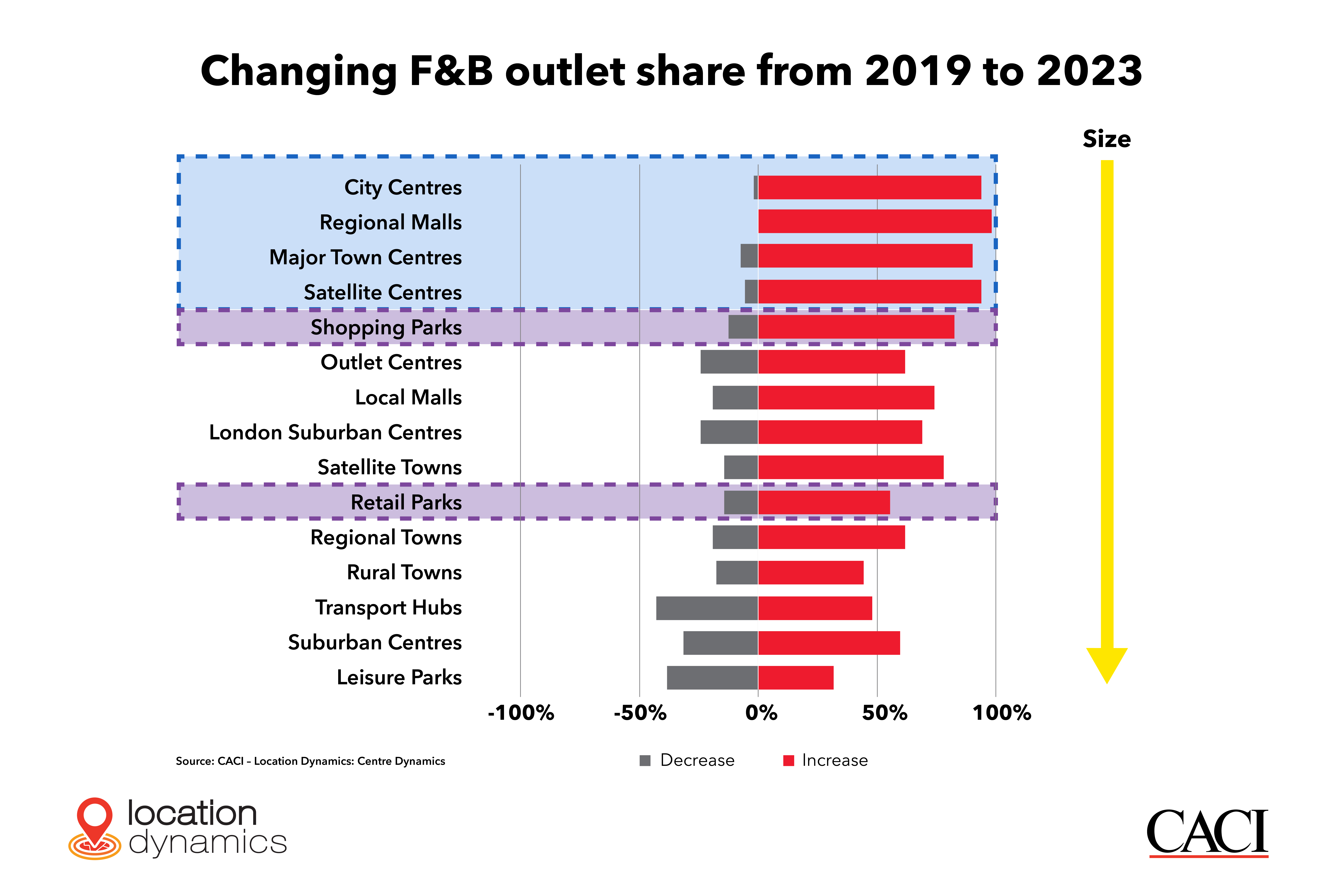

Over the course of 2019 to 2023, most retail centres in all asset classes have grown their share of food and beverage (F&B) outlets, noting an increase in over 90% of centres in the top four classes— City Centres, Regional Malls, Major Town Centres and Satellite Centres. Despite F&B having become increasingly prominent in shopping and retail parks, there has been a mixture of increases and decreases observed in towns, transport hubs and leisure parks, raising the question of whether oversaturation has had a role to play in some locations.

Centres are polarising

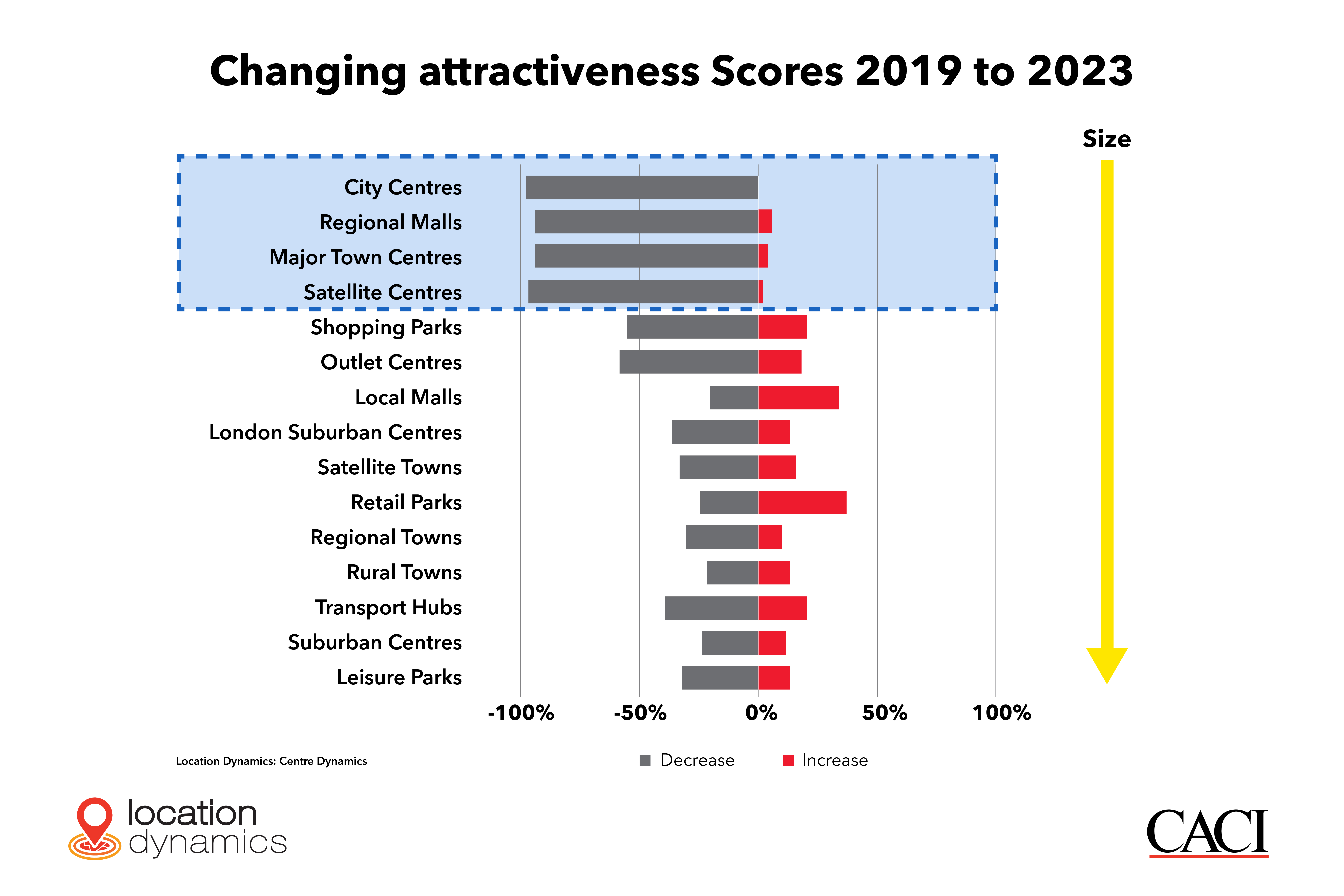

Over the same time period, city centres, regional malls, major towns centres and satellite centres have dropped in their overall level of consumer attractiveness in line with consumers’ changing behaviours. So much so, that the four largest asset classes have seen declines in over 90% of their centres. The picture is a bit more mixed as the retail hierarchy descends into towns, transport hubs and leisure parks, however, with an average of 40% of centres in these asset classes seeing a decline. The ever-increasing proportion of consumer spend moving online has undoubtedly prompted these downward trends.

Given the vast differences in changes at an asset class level, and with many exceptions at a centre level, having access to detailed data on the changing attractiveness and demographics at centre level is vital.

Customer behaviours towards QSRs continue to change

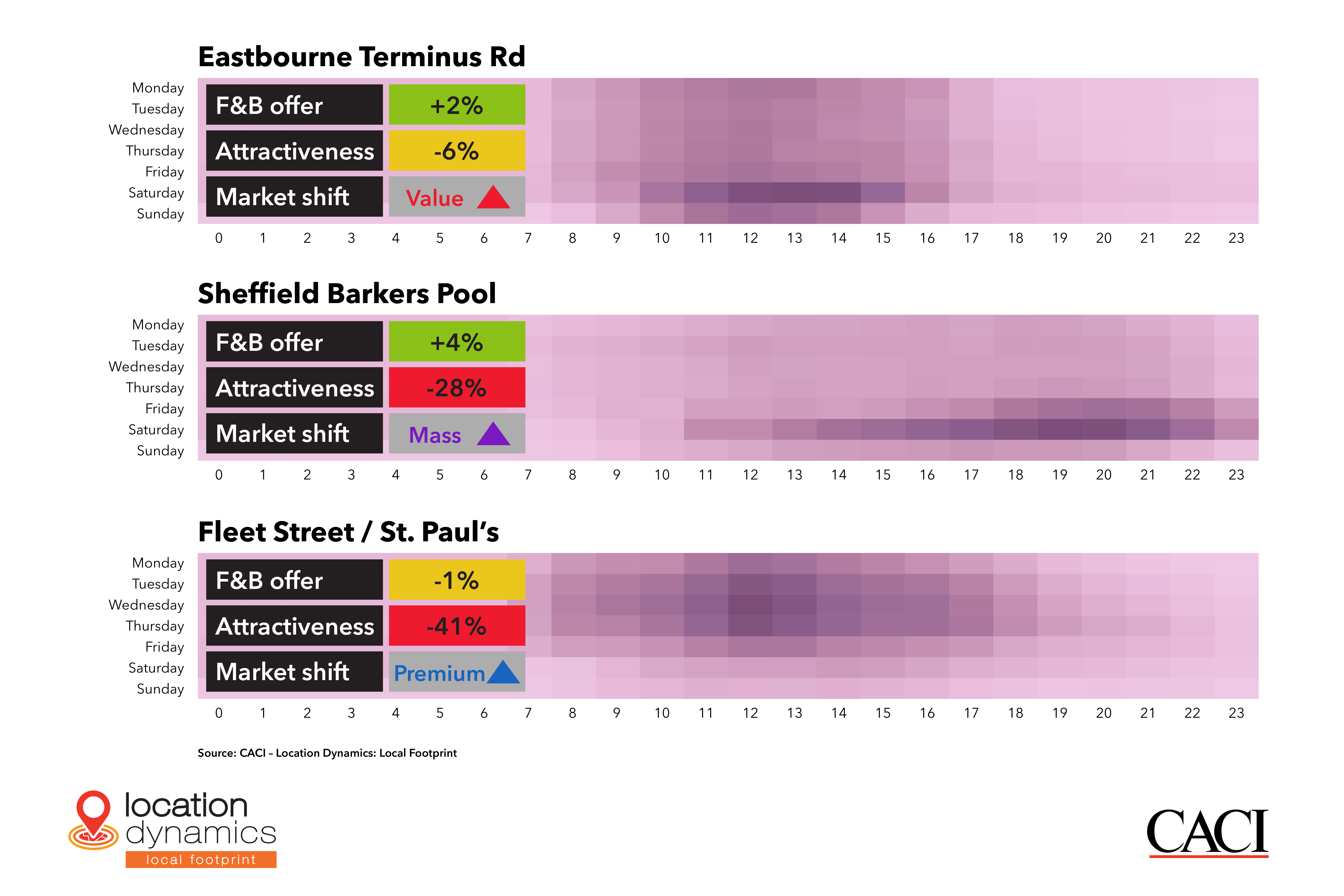

Many may think that post-Covid QSR demand is just about Tuesday to Thursday, driven by changes in working behaviour, but this is an over-simplification. CACI’s local centre mobile app data analysis within our Location Dynamics suite shows that while areas like Fleet Street/St. Paul’s in the City of London now do have a pronounced Tuesday to Thursday peak, it’s far from the universal norm. As shown by the dark-shaded time segments in the graphs below, places like Barkers Pool in central Sheffield have a very pronounced Friday and Saturday night economy. This further contrasts with central Eastbourne, which has maintained a more traditional Monday to Sunday 9 a.m. to 4 p.m. custom and a strong weekend daytime custom.

Ultimately, locations are different, and successful operators must understand the different ‘missions’ their customers will be on to ensure they meet their customers’ needs and ensure that they staff their outlets to provide the right level of services at times demanded by their customers.

For food-to-go retailers to engage with consumers at the right time and in the right place, it will be critical for them to consider:

- The F&B offers in local areas

- Changing consumer behaviours as a reflection of new and embedded worker patterns,

- Centre attractiveness

- Overarching market shifts that impact footfall on specific days and times.

How CACI can help?

With these trends in mind, it is critical for food-to-go retailers to have a detailed understanding of who their customers are, where they are located and what times of the week they are most likely to interact with your chain or restaurant. It is equally important to understand your place in terms of its attractiveness to customers and the effect of its location on driving footfall.

Data is key to maintaining a competitive edge amidst evolving trends, an area where CACI excels in providing support. Find out how we can keep you and your team ahead of the curve by reaching out to us today.