The 9 Critical Risk Factors

If you’re poised to push the button on a field force reduction programme or you’re considering your options to control costs in a post-Covid world, make sure you’ve considered these 9 critical risk factors before you take action.

These are challenging times for brands, retailers, field merchandising and field sales organisations. Commercial pressures and dramatically changed consumer behaviours and motivations have thrown established business models into question. In field force strategy, planning and operations, it’s no surprise that downsizing to reduce costs is under consideration for many organisations.

We get it. Field forces are expensive – in our clients’ experience it can cost around £72K per head to put a single rep on the road. Training, travel costs and salaries add up. The pandemic has brought these costs under intense scrutiny.

There’s also pressure to shift field force resources to other channels. Field reps are not the only way to influence retail sales – alternative and potentially cheaper channels include telesales, digital, crowdsourcing and outsourcing.

With lower sales volumes and a high cost to serve, a regular and comprehensive field visit programme is beginning to look prohibitively expensive for some companies. Some clients tell us they’re looking at field force reduction because individual or entire channels of outlets have closed due to Covid-19. Others report that every division is being asked to make specific savings or percentage overhead reductions.

If you manage a field force or are responsible for the direction and strategy of field merchandising and field sales, we urge you to take a closer look before you take action. There’s certainly an opportunity to improve the effectiveness and efficiency of your field teams, but it might not be in the way you think.

Here’s What You Need to Consider:

If reductions are needed, you must be certain that you’re making them in the right places, so you’re not cutting off vital sales and profit opportunities at the same time.

1.The Current Situation as a Fact

Justifying change to individuals – and other stakeholders such as HR – is easiest when you have objective evidence. Clients often approach us with strong beliefs about the size and structure of their field sales team. They see a very different picture once they’ve reviewed an objective analysis. You need an accurate, factual view of the status quo before you can decide how best to change it.

2. Geographic Optimisation for a Leaner Field Force

Fewer heads in the field team means resource is spread more thinly, which will likely mean more driving. Do you decide to focus on more easily accessible metropolitan areas and leave further-flung outlets uncovered? What will the impact be on market share and sales performance? If your reps are used to a regular weekly or fortnightly visit schedule, is there a better way to deal with geographical outliers? You need to assess the impact of reducing visits – it may be greater than you think.

3. Enhancing Visit Focus and Frequency

With fewer heads, you could cover the same number of stores with a reduced visit frequency. It might mean more driving for reps, and proportionally less time spent in-store. It might also lead to a decrease in sales because of a lack of engagement. You need performance data and market information to assess where you can afford to make these adjustments.

Simplifying your contact strategy can have a big impact on call rates: our research amongst clients shows that adding a second tier of visit frequency typically increased team driving time by 20%.

4. Rebalancing the Mix of Outlet Support

You could move less lucrative outlets off the field sales roster, handing them over to other methods of contact, or set up to alternate rep visits in person with phone calls. But which will be the most effective – and cost-effective – approaches? How do you match digital, telesales or outsourced support provision with the individual retailer or catchment type? You need insight that helps you categorise outlets in terms of risk and opportunity and provides evidence for the best way to change your visit strategy.

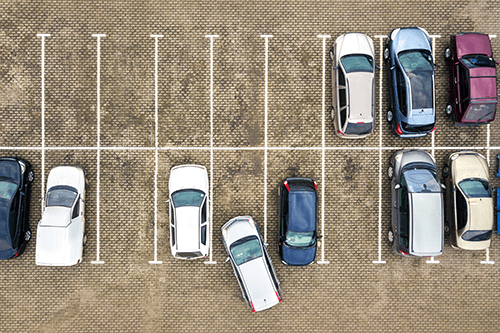

5. Balancing Territories

Once you’ve decided how many people you need in your rebalanced team, how do you best carve up the geography? Having the right number of people is only the first step to creating a good territory structure. You also need to allocate geography to balance workload. Workload isn’t just about in-store activity: it also includes driving. Reps with more remote territories can’t achieve the same level of calls as those in more compact territories. You need to navigate the road network ultra-efficiently, giving your reps routes that help them spend as little time in the car as possible.

6. Recruitment and Rep Locations

You need to weigh up physical location as well as experience and skillsets. Studies show that reps can reduce their commute time by 43% if they live in an optimal location for the territory. This helps them achieve better work-life balance, maintaining engagement and performance in challenging times. But what if the people who live in the right place are not your best performing reps? You need to review the impact of adjusting territories to accommodate more skilled sales personnel. Ideally, recruit candidates for vacant territories who are based in a convenient area, and know who is prepared to relocate before you make key changes.

7. Skills Transfer

If you’re consolidating teams and territories, you need to audit people’s skills against your business requirement. Capability and high performance in one channel does not necessarily translate into another channel: there may be a retraining cost and you may lose strong team members who don’t want to reskill. Increasing reps’ remits could reduce success and impact in their previous areas of focus. Before you make these kinds of changes, you need to make a realistic assessment of the likely effect on the bottom line.

8. Economies of Scale

Mergers, acquisitions and liquidations are all possible scenarios in the current climate. This could put more products into the field force brief and present the opportunity to merge multiple sales teams, to avoid reps from each entity going to the same places. As some channels fail and others prosper, you may want to switch resource from the struggling channel to address opportunities in thriving markets. There are economies of scale from removing duplication of in-store activity, while more heads will mean less driving. Our research has shown that merging teams may create a single team 10% smaller than the combined entities, with 20% less driving overall.

9. Building in Resilience and Agility

How long will Covid-19 continue to impact retail and brand performance? It’s a question no-one can answer for sure. Jettisoning people now might make for a healthier bottom line in the short term, but as the months unfold, going too far and too fast could prove a fatal mistake for brands and retailers. As the market recovers, it will be hard to seize the opportunity if brands and sales operations have to embark on a costly and time-consuming recruitment exercise and factor in time for a newly minted team to achieve its potential. Lost revenue and competitiveness will far outweigh the earlier short-term saving.

We recommend a phased approach, with a low-impact short term option that can be implemented relatively easily. Scope out more radical options to keep on the back burner, so you’re prepared in case you need to go further and deeper.

Moving Forward With Your Field Force: What to do Next

Size does matter in the field: you need reach and resources to compete effectively. What’s vital is focusing on profitable priorities and maintaining an agile field force that can adapt to fast-changing circumstances. You need accurate information so you can manage risks and understand the likely impact on your business and brand performance in the short and medium terms.

If you urgently need to make decisions about the size of your field force, you’ll need robust data insight and evidence to reform effectively. The CACI field force team can help you make a rapid and reliable evaluation of your options, based on your unique performance data along with the latest market data and insights.

Access Free, Strategic Expert Advice For Field Operators

We’re offering a free initial ‘Coming back from Covid’ consultation for field sales and field merchandising, to help you move forward at pace. Share your current situation and challenges and we can help you take the first steps to map a route to an agile and profitable field operation fit for the current environment. Get in touch with us for more and to book your free consultation.