How WhatsApp and Braze are enabling conversational customer engagement, support, and overall business growth.

If you haven’t considered adding WhatsApp messaging to your business strategy, you could be missing out on an effective channel to power customer engagement, support, and overall growth.

Messaging apps are becoming the channel of choice for customers wanting to connect with businesses. In fact, a survey in 2020 discovered that 75% of respondents prefer this method compared to other channels.

With just over 2 billion monthly active users and an 85% penetration rate in parts of Latin America, Asia, and Europe, WhatsApp is currently the most popular messenger app worldwide, offering businesses massive consumer reach. Hundreds of enterprise businesses are already using WhatsApp Business Messenger to their advantage.

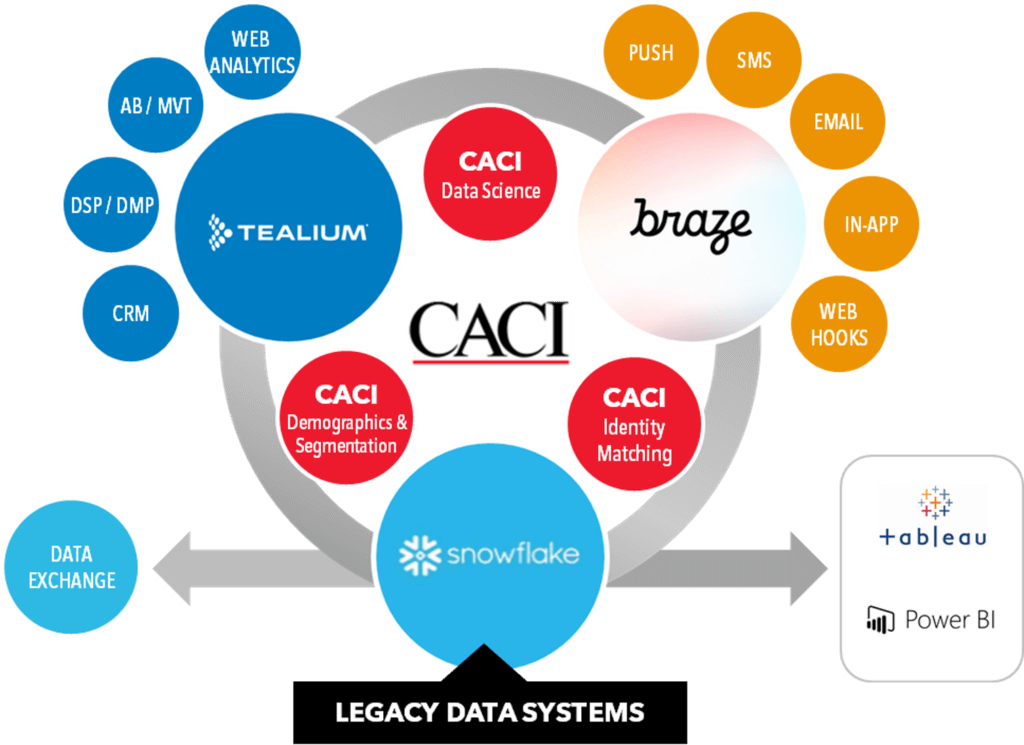

The most effective strategy for integrating WhatsApp begins with having a fit for purpose customer engagement platform that will enable your team to scale, streamline and unify your WhatsApp messaging. Braze, one of the leading customer engagement and cross channel marketing platforms has recently launched full WhatsApp capabilities.

What makes Braze the ideal customer engagement platform to integrate your WhatsApp strategy? Braze unifies your channels and messaging, to streamline and scale two-way conversations and minimize additional technology or marketing costs. If you’re interested in learning more about how Braze can enable your team, be sure to read our blog post “Accelerating value realisation with CACI and Braze”.

At CACI, we are committed to helping businesses discover new and effective ways to connect with their customers. We are excited to see how Braze is enabling enterprise businesses to launch and optimise their WhatsApp programs both in terms of audience size and use cases. From resolving customer support issues to sending personalised marketing messages, let’s explore some WhatsApp business use cases below.

WhatsApp messaging is resolving customer queries while minimising additional support resources.

Imagine a customer in a different time zone with a question about their recent purchase delivery date. Instead of having to wait to speak with a live support agent, a WhatsApp chatbot can automatically retrieve the customer’s order number and provide them with their delivery details, saving the customer time and eliminating the expense of a live customer support agent.

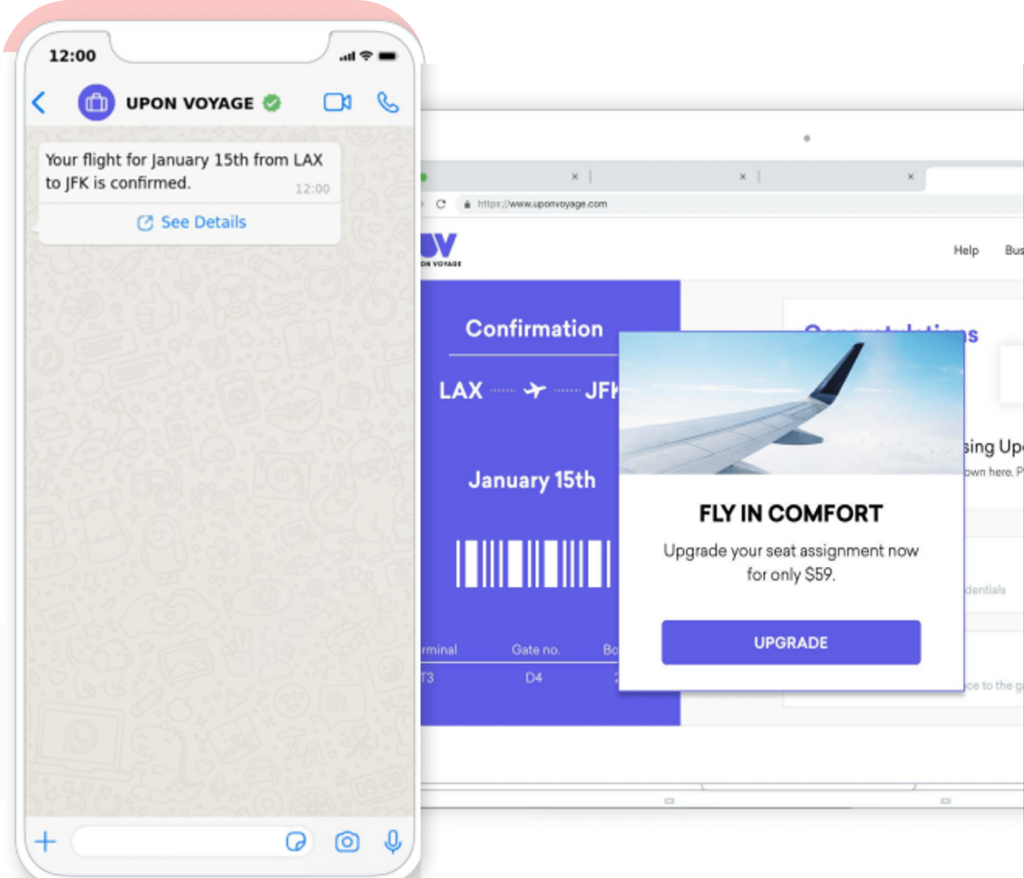

Another example is travellers opting in to receive anything from their boarding pass to flight information, such as changes in schedule or boarding gate, last call before the plane door closes, or even the baggage delivery belt on arrival, all via WhatsApp.

Figure 1: WhatsApp Messages to Resolve Travel Customer Support Queries.

WhatsApp is also effective for driving deeper customer engagement and conversions.

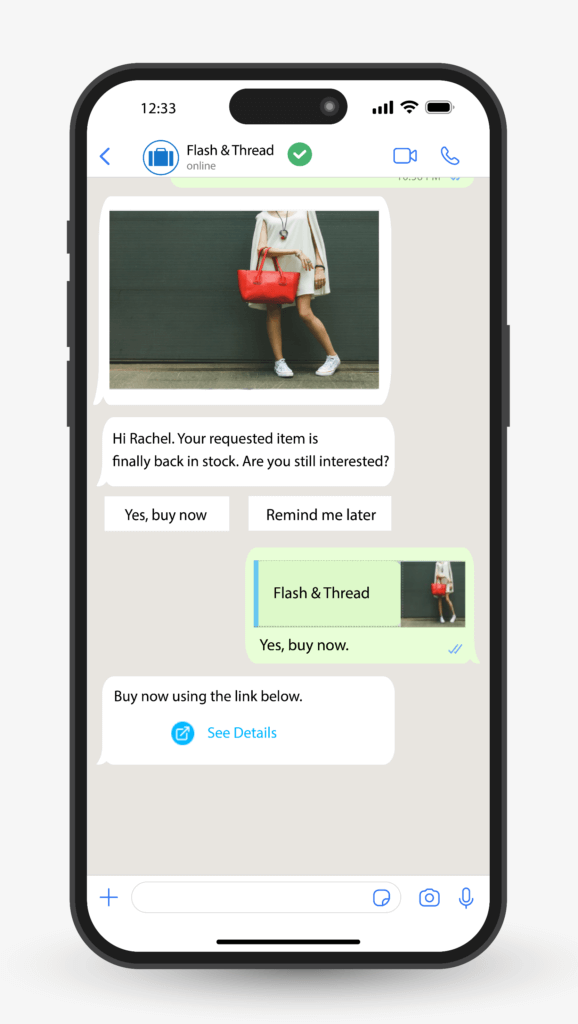

Businesses often struggle with cart abandonment or a loyal customer suddenly disengaging. Sending a personalized WhatsApp message along with a promotional code can be a quick-and-easy way to bring a customer back. In fact, one report found that click-through rates for cart abandonment messages via WhatsApp performed over eleven times better than SMS (36% vs. 3.2%).

Additionally, WhatsApp’s ability to insert dynamic content and link directly to web pages allows businesses to send engaged customers informational messages about new products, restocked product availability, and other exclusive benefits. These actions can be significant revenue drivers for your business.

Figure 2: WhatsApp Messages to Drive Conversions.

Leveraging a new platform also comes with unique challenges.

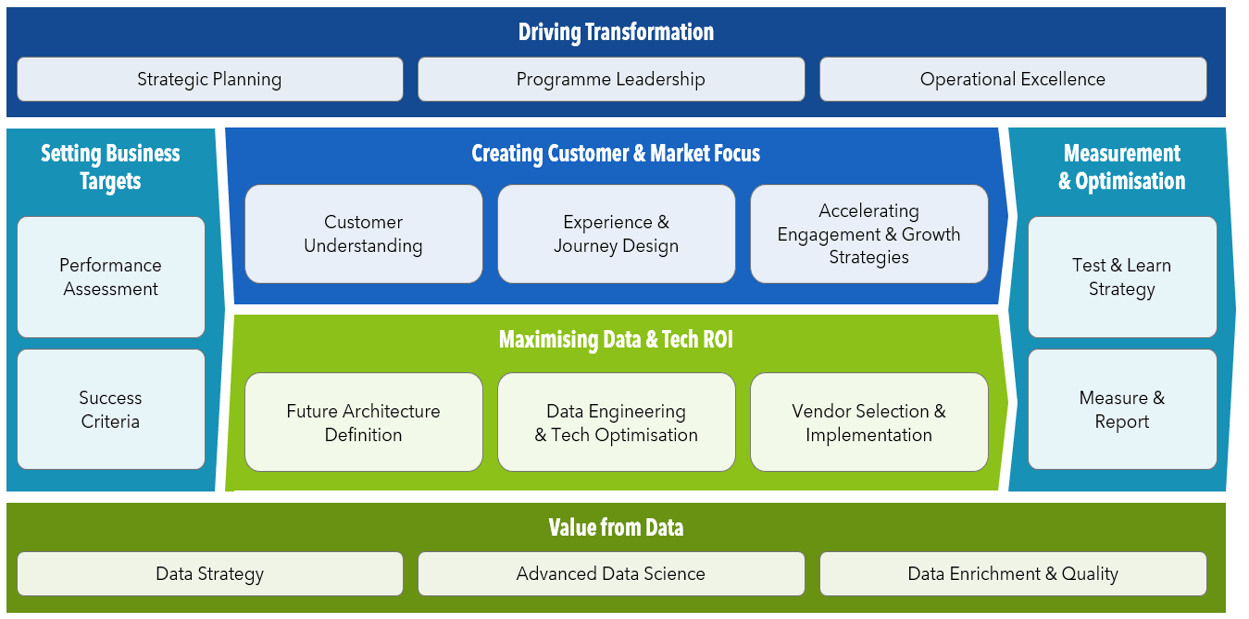

While the examples above support a growing business case for WhatsApp messaging, leveraging a new platform also comes with a unique set of challenges. Whether it’s finding the right customer engagement platform, understanding the short- and long-term financial impact, or operational considerations like upskilling internal teams, these are all key factors to consider. Far too often, businesses rush into adopting a new platform or channel without fully considering the financial, organizational, or customer impact. Unplanned or poorly executed strategies can be detrimental, both in terms of cost and reputation management.

How CACI can help

At CACI, we encourage businesses considering a new platform or channel to begin by identifying the customer needs, followed by platform or channel relevance, and finally business impact. If your business is interested in learning more about WhatsApp messaging or a customer engagement platform like Braze, CACI’s technology, data, and CX capabilities can help. Contact us to learn more.