Capability: Market Insight

What makes a place ‘perfectly balanced’?

Only 1.5% of locations across the UK can be described as balanced across all pillars. We set out to find these locations and determine what sets them apart in our report, “Six Pillars of Success: Building Resilient Places”, where we explored locations across the UK that are “balanced” in all six of CACI’s property pillars that contribute to the resilience of both community and place. Over 5,000 locations across the UK were assessed in this report, of which only 77 were considered balanced across all pillars.

Interestingly, only 1 in 20 regional towns in the UK are balanced. This demonstrates that despite achieving perfect balance in some places, there is still a lot that can be done for places to enhance their community engagement.

In this blog series, we’ll uncover the defining criteria for ‘perfectly balanced’ places and find out how these communities’ tactics can be applied to other locations across the UK.

Pillar 1: Representation & proper sizing of independent & chain retailers

Having retailers that ensure a return on investment for occupiers and effectively appeal to locals’ needs along with proper leasing of a retailer in terms of its tenant line-up are critical to an area’s success. A ‘perfectly balanced’ place achieves a balance between chain retailers to boutique shops and independent retailers by understanding the core of their community’s personalities and values and reflecting that in the area’s retailers.

Pillar 2: Uniquely tailored offline experiences

Unique offline experiences are ones that are only available in person and cannot be replicated at home. A place that is ‘perfectly balanced’ will host things to see and do for customers to do in person that come with halo benefits and contribute to the overall liveliness of the area and can only be experienced in person. The results will be achieved through an uptake of dwell time, varied footfall patterns, greater customer spending and more.

Pillar 3: Engaging community infrastructure

The types of amenities and services offered in an area can play a vital role in enhancing social value and community engagement. A ‘perfectly balanced’ place has optimised its relationship between supply and demand across amenities to help commercial landlords plug gaps within the community and reinforce social value.

Pillar 4: Support social cohesion through optimised residential design

A lack of suitable housing can be damaging for an area. ‘Perfectly balanced’ places optimise their residential design to positively influence the community and create long-term value, income and footfall for developers. These places typically feature residential units that closely align with the needs of the community and offer the right types, tenures, sizes and price points to fill supply gaps

Pillar 5: Sufficient & accessible work opportunities for the local population

Communities need job opportunities for those looking for employment. Acute un- and under-employment can be damaging on both an individual and community-wide basis. In our post-pandemic world, 29% of the UK population work in hybrid roles, allowing them the option of splitting their work week between the office and home. A ‘perfectly balanced’ place offers working opportunities that reflect the demand levels of the area and increasingly include collaborative, co-working spaces.

Pillar 6: Appealing open spaces for the community to dwell in

To drive footfall to a location, a ‘perfectly balanced’ place draws people into spending their leisure time there. It will be conveniently located, offer appealing services and amenities and encourage dwelling and exploring. With an increased interest in greening urban environments and finding pockets of greenery in even the most unexpected spots, ‘perfectly balanced’ places will offer luscious open spaces that are built sustainably and encourage biodiversity and carbon capture.

Stay tuned for our upcoming blog featuring the first two of our top five ‘perfectly balanced’ places to live.

To learn how our six property pillars can help ensure you are creating resilient places, please speak to one of our Placemaking and Property experts.

Background

Nansledan is a new community being built on the eastern edge of the coastal town of Newquay in Cornwall, England. Over the last decade, the Duchy of Cornwall has acted as master developer and landowner of the development, creating an already vibrant community which will eventually include c4,000 homes, job opportunities and diversification of the local economy to sustainably meet Newquay’s current and future needs.

To bring the vision of a successful and thriving new community to life, the masterplan for Nansledan includes a new town centre, known to the Duchy of Cornwall as “Market Street”. To facilitate the progress an introduction was therefore made to CACI, to demonstrate the breadth of data and consultancy expertise that could be offered to support the forward strategy of Market Street.

The Challenge

To answer questions around the scale and mix of spaces within the Market Street plans, it was clear that data-driven insights would also be helpful in shaping the forward strategy.

The Duchy of Cornwall also wanted to understand what role Nansledan might play within the wider Cornish market and how complementary offers could be provided so as not to compete with Truro, Newquay and Padstow.

The Solution

CACI’s initial report has now been completed and was presented to the Duchy of Cornwall in February 2023. It has already been helpful in shaping the forward strategy for the first phase of Market Street and will continue to inform the scale and the mix of space that comes forward across Market Street and Nansledan over the coming years.

The Duchy of Cornwall now has a much clearer understanding of Nansledan’s catchment area from both a resident and tourist perspective around demographics, spending habits and spending potential. In turn, this is expected to help in the positioning of Market Street within its local and regional market and will hopefully assist with ensuring its long-term commercial success.

The Future

While Market Street is yet to be developed, the work undertaken by CACI so far has helped to shape the Duchy of Cornwall’s forward strategy and will continue to feed into the design of the remaining phases of Market Street, as well as other commercial centres that were planned across Nansledan.

Further advice is expected as the development progresses and wider market influences take shape in order for the Duchy of Cornwall to continue to position Market Street appropriately for Nansledan’s growing population, as well as that of other local towns and villages. Using data-led insights on an ongoing basis is seen as increasingly important given the wider context of struggling retail centres around the country and in trying to ensure a vibrant and thriving centre at Nansledan.

Read the full customer story here. For more information on how our data and solutions can support your business growth please get in touch with us.

Background

The challenge

- Identifying the most viable locations for retailer recruitment, taking into account the demographic profiles that each retailer serves

- Having a rich insight into the overall market potential of each Amtico retailer

- Understanding and being able to map their target consumers across the UK

The Solution

- Investing in InSite enables Amtico to prioritise retailer acquisitions based on the greatest headroom potential whilst leveraging demographic data

- InSite enables Amtico to quantify their market potential based on the demographics of their consumers

- An actionable and strategic tool that Amtico are able to share with multiple stakeholders across the business

Read the full customer story here. For more information on how our data and solutions can support your business growth please get in touch with us.

Pay is only one factor that influences the number and quality of candidates for your roles, and their loyalty.

It’s no secret that staffing is an ongoing challenge for most providers of elderly care. Market competition doesn’t only come from other care settings. Potential staff may be looking for local work in a range of sectors locally, where hourly pay is higher and the responsibilities seem less demanding. How can you compete to attract and retain quality staff for your elderly care services?

Take a targeted approach to recruitment and retention by applying marketing principles

Traditionally, elderly care providers have used their instincts to decide on good locations for their residential or in-home care operations. In recent years, some have made good use of market data to investigate and understand their potential customer base. By looking at the age and affluence of potential care clients in their catchment area, savvy operators can anticipate the level of need, design the right services and price them competitively. Today, we’re advocating the same approach, to understand staffing supply and demand.

In our work with a few forward-thinking, large-scale elderly care providers, we’ve helped them to factor in staffing availability when looking for new sites or deciding whether expand operations in an existing location. There’s a great opportunity for mid-sized operators to take advantage of the same approach.

Using local market insight and benchmarking to identify potential staff

Using demographic and location data, we can:

- Profile the demographic characteristics of ideal candidates for elderly care roles

- Contrast them to the Acorn profiles of typical users of the elderly care services

- Flag high-risk locations likely to face the biggest staffing challenges

- Highlight areas of demographic overlap, with a strong potential customer base and staffing base

- Identify the best catchment areas to recruit suitable candidates

- Analyse the likely needs and priorities of available candidates in the area

Contextual dynamics in practice: understanding local recruitment landscapes

Our current work with elderly care providers is commercially sensitive. So, we’re using an example from a different care sector with a very similar recruitment and retention challenge – children’s nurseries.

Our client told us that recruitment challenges are hampering business performance – they had had to close some sites because of a lack of staff. They needed to factor the potential to recruit into acquisition decisions. We profiled 11,000 staff members in 400 nurseries in the UK to discover their Acorn groups and identifies primary and secondary target staffing groups. We mapped nurseries in their locations, showing where the customer base and the staff base overlapped. This helped our client tailor recruitment messaging to available local staff priorities. They could plan to expand their service provision in locations where they knew they could recruit to meet demand.

Modelling the recruitment potential for new and existing locations

The approach is not only relevant for new elderly care locations and investment. By understanding the local employment landscape, you can recruit in a more targeted and effective way and find out what matters to the people you’d like to employ, so you can shape working practices and promote aspects of the role that will be most appealing.

Location and mobile app data can you help you focus recruitment in areas where there are candidates who can easily access your sites and domestic clients. Your potential staff don’t necessarily live on the doorstep but there may be nearby areas that have good transport links, where workers already tend to travel from.

Offering roles that local employees want to take

Of course, pay is a very important factor when it comes to attracting competent and committed staff. Premium elderly care operators may be able to pay staff more and offer a more luxurious workplace. But these are not the only things that influence employees. You can provide other, affordable benefits and mould your working environment and employee programmes to match what workers really value. Profiling target candidates in your local area can help you understand their priorities – from family-friendly working hours to free lunches and incentive programmes.

Beyond pay and benefits – understanding the appeal of elderly care roles

Working in elderly care is a socially responsible job. For some candidates, recognition of the value of their work can be a strong motivator. Creating better career paths and more tangible pathways for carers can make a big difference to your recruitment. Some larger elderly care operators are trying to emulate nursing pathways: clear role definition and progression can help to retain committed staff. If you understand more about the potential candidates in your area and your existing staff, you can decide whether this approach could support recruitment and retention for one or more locations.

CACI’s specialist elderly care and senior living team works with clients in the UK to help them improve operational and financial performance with access to vital insights into their customers, employees and locations. To find out more, contact us.

About Knight Frank

For over 20 years, Knight Frank has partnered with CACI to achieve a long-term vision of becoming the world’s leading independent property advisor. Knight Frank works with various industries and businesses on their property and location planning strategies. Accessibility to reliable and accurate information to successfully serve clients and the ability to build authority as a market leading commercial agent have remained at the business’ core throughout.

Despite Knight Frank’s wider recognition for its work within residential property, the business is evenly split between residential and commercial real estate. In recent years, the general climate surrounding realty has become increasingly challenging, with macroeconomic conditions weighing heavily on this industry globally, particularly in terms of capital market investments. To manoeuvre these challenges, Knight Frank has been using CACI’s GIS software, InSite, along with various CACI datasets such as Acorn, the UK’s leading geodemographic segmentation tool.

The Challenge

Knight Frank’s primary challenges have been twofold:

• Determine how to navigate ongoing global uncertainty in the real estate industry.

• Handle volatility in capital investment markets.

Stephen Springham, Head of Retail Research at Knight Frank, elaborated on the impact that these challenges have had on the business.

Stephen explained:

Capital market investment is key to real estate markets and obviously that is probably at the sharpest end of economic sentiment. Investor sentiment isn’t sky high at the moment, so that is probably the biggest barrier we have to overcome, although we’re probably not radically different from most global companies in that regard.

The Solution

CACI’s InSite software has significantly supported Knight Frank’s business endeavours through both the nationwide insight from Acorn, as well as the shopper understanding from the machine-learning

catchment model, Retail Footprint. “It’s a window to the world of data. A lot of those datasets are bespoke and unique to CACI,” Stephen explained.

Additionally, CACI’s business consultancy solutions and thought leadership have been supporting Knight Frank in improving their overall business functions by supplying the business with the necessary tools to effectively advise retailers and support due diligence regarding buying and selling within the capital market.

The Results

According to Stephen, there has been a noticeable uptake across the business in data usage, with several transactions on shopping centres Knight Frank completed over the course of last year that were achieved

thanks to the support of CACI’s data and InSite tool.

One of the business’ recent and most notable acquisitions came in 2021, with Knight Frank acting for Redical in the purchase of the Victoria Gate/Victoria Quarter Shopping Centre in Leeds. This £120-million deal was executed in part through a deep dive of data provided by CACI’s InSite tool.

The Future

While Knight Frank continues to have an open dialogue with CACI on any new developments or datasets that could continue to support the business’ initiatives, CACI’s InSite and data have created a notable foundation.

Read the full customer story here. For more information on how our data and solutions can support your business growth please get in touch with us.

How does a challenging economy affect consumer choices and priorities that shape the UK market for elderly care?

It’s no surprise that the cost of living squeeze is having an impact on elderly care operators. Private residential and domestic care cost money: consumers are looking for ways to economise. Older people want and need comfort and care as much as ever, but they and their families are tightening their belts. Inevitably, they’re considering the cost of different care settings and options.

What does this mean for residential and domiciliary care providers? It’s early days, but as for every other consumer sector, you need to be prepared for the market to change. A proactive approach to understanding current and future customers and modelling potential demand in your locations can uncover opportunities to maintain occupancy and optimise your services to match evolving priorities and needs.

If you don’t have a crystal ball to hand, that may sound like a tall order. But knowing and anticipating market demand in your locations doesn’t depend on magic or guesswork. Consumer and location data together provide reliable evidence that can help you identify ways to stay relevant, accessible and financially stable.

Not all groups are impacted to the same extent by the rising costs of living. The majority of Acorn Groups still have a sizeable disposable income despite the recent 5% average fall.

Source: CACI Paycheck Disposable Income 2022 v2

Despite the bleak headlines, the economic impact varies considerably for different household types and in different areas. Many older consumers still have savings, disposable income or assets that allow them to choose the care they want. If you can understand the profile of your current and future customers in detail, it’s easier to identify and reach out to local prospects.

Location intelligence data is a well-established source of insight for care home operators and domestic care providers that are considering expansion or new sites. Mapping the age and affluence of the local population in a potential catchment helps to indicate where there’s likely demand for elderly care services.

But alongside age and income, there’s a lot of more subtle data that can help you market your existing services, confirm or reshape your propositions, benchmark your pricing and adjust the range and type of services you offer. This type of insight is extremely useful in a fast-changing market.

CACI data insight can answer crucial questions about your customers and market:

• What are the characteristics of your local and target customers?

Acorn profiling groups UK consumers by affluence, life stage and priorities

• What are your current and potential customers thinking, feeling and intending to do differently?

Quarterly Consumer insight surveys of the UK population

• How has customer spending on different outgoings changed?

Transactional spending data shows the split of spend with different brands and operators

• Whose disposable income is affected?

Postcode model of income in different locations, showing how it’s being spent.

• What’s around the corner?

Dynamic modelling forecasts what could happen to consumer spending if inflation, fuel and other costs rise in a range of different ways

CACI’s current disposable income model reflects the changes we’ve observed in the last few months. Although all households are affected by rising costs, the majority of our Acorn consumer profile groups still have a significant disposable income. It’s groups like Student Life and City Sophisticates that have seen the largest decline, driven by property costs.

There has been major growth in spend on private healthcare, with a wide range of demographics prioritising health over other non-essential spending.

Source: CACI Transactional Spend, June 2022

For elderly care operators, it’s encouraging to note that Comfortable Seniors, Countryside Communities and Successful Suburbs, who are likely to form far more of the target market, have some of the highest levels of disposable income, reflecting smaller or non-existent mortgages, good pensions and comfortable savings accrued over previous years.

Spending on private healthcare has increased in the past year. The Covid-19 pandemic and concerns about NHS waiting lists are driving this change in priorities for households across most Acorn groups. Despite rising essential costs, many consumers now regard healthcare expenditure as a necessity, not a luxury. This could have a positive impact on perceptions of value in elderly care.

These are just the headlines from our latest national data. Every elderly care provider has a different operating model and works in unique locations. CACI’s health and social care team can select data and build customised reports that directly reflect the opportunities and changes happening in your catchment areas today and tomorrow. For mid-sized operators, it’s vital decision-making information to inform strategy and tactical decisions that will help your business compete and thrive in a challenging economy.

We can help you:

• Continuously analyse, monitor and adapt – stay ahead of policy and new competitors when finding new customers and recruits

• Tailor marketing engagement and recruitment key messages to reflect the requirements of local potential pools of customers and staff

• Understand your staff and customer base and how its segments are impacted by different cost of living challenges, to identify risk and opportunity

• Tailor your offer to changing consumer and staff requirements

CACI’s specialist elderly care and senior living team work with clients in the UK and internationally to help them improve operational and financial performance with access to vital insights into their customers, employees and locations.

To find out more, contact us.

Over the last three years, we have seen a more significant shift in consumer habits than we could have imagined. Currently challenged by the rising cost of living and an economy in recession, the post-pandemic spending bubble was cut much shorter than initially anticipated by economists.

Like everyone in January, CACI reflected on the last few years, and as part of this, we revisited predictions that we made during the height of the Covid-19 pandemic. Consumer behaviour changed significantly in the space of several days, triggered by widespread temporary store closures during the lockdowns. Some stores were never able to reopen; whilst online platforms boomed, in light of these significant behavioural shifts, CACI rebuilt predictions to reflect this new normal.

How close were CACI’s consumer online spending predictions to actual results?

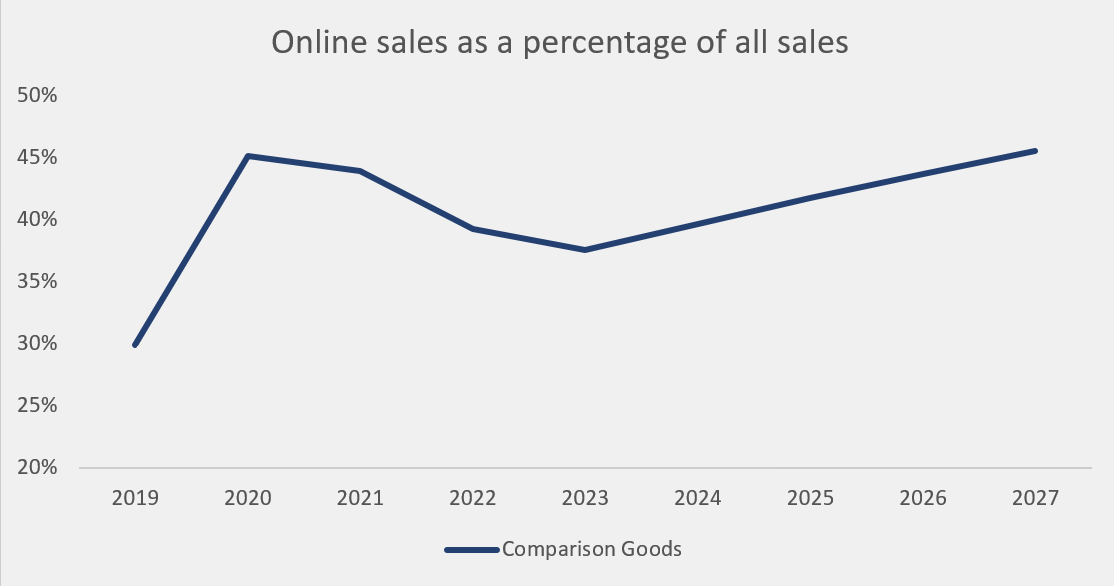

Mirroring our spend predictions, a phrase we maintained at CACI at the time was that “online spend jumped forwards five years in one month”. What we have come to realise was that three years on, these spend predictions, shown in the below chart, highlighting a return to in-store, were very close to the true picture.

How can CACI track consumer online spend behaviour?

CACI can unpick these new trends in spend behaviour using our new and exciting tool kit of Spend Dimensions and Brand Dimensions, which tracks over 200 shopping centres and 300 brands across the UK.

What we can see demonstrated in the above chart is a post-pandemic slump in online spend as a proportion of total spend. In 2023, online spend falls to 38%, before gradually rising again in the preceding years.

Whilst the current split in online and offline engagement provides us with an overall national average, it is important not to expect all shoppers to follow suit. We have seen asset type, product category, brand, region and demographics all play a big part in the extent to which a shopper might engage online.

Who is most likely to shop online?

Demographically, the split between those engaging in-store and online has become less distinct, highlighting the closing of the digital gap between young and old, with the difference between online market share across all groups dropping from 10% to 5% over the last year.

However, the big picture doesn’t change. Key online shoppers continue to be younger shoppers across the affluence spectrum as well as more affluent shoppers, likely driven by greater access to e-commerce platforms and the ability to afford delivery costs.

How does this vary by product category?

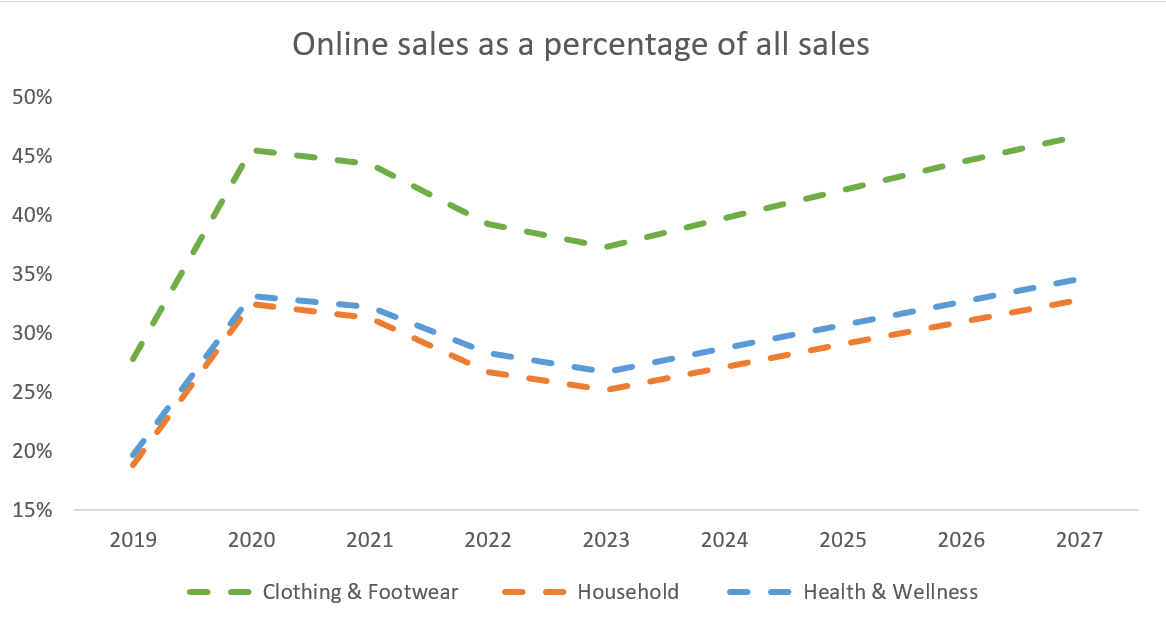

The recent shift back towards in-store engagement isn’t clear-cut and does vary by product category. CACI expectations were that the drivers of the overall return to the store would be clothing and footwear, household and health & wellness brands. This has been the general spend trend that we’ve been seeing across the UK since 2020.

The variation by category gets further exacerbated by the time of year. For example, comparing the months of October to December 2021 and 2022 in the chart below, there was a clear shift for household and kids’ goods spend to in-store, likely driven by the desire to experience before purchasing. Whereas, General Retail painted an interesting picture within the final quarter of 2022. Both in 2020 and 2021, with Black Friday and Cyber Monday taking place in November, Christmas hit online earlier than in-store, boosting online’s share of the market temporarily. In December, our Christmas survey reiterated this sentiment, with over half of those shopping online citing a main drive of this being concern with the rising cost of living and saving money, whereas over half of those shopping in-store did so for the experience. The experience-focused, in-store shoppers drove the resurgence year-on-year of in-store spend in December.

What does the return to in-store mean for retailers?

Across the 300 brands we tracked, many pure online brands are experiencing a decline in market share, in-store brands have typically performed well, and those blended brands have seen a shift towards a greater in-store market share. The power of the store can be seen through brands such as Decathlon, Nespresso, Build-A-Bear and Denby, who have all shifted to greater reliance on the store over the last quarter. In comparison, online disrupter brands such as Vinted and Shein which thrived through the year began to see a drop off.

What does the future of consumer online spending behaviours look like?

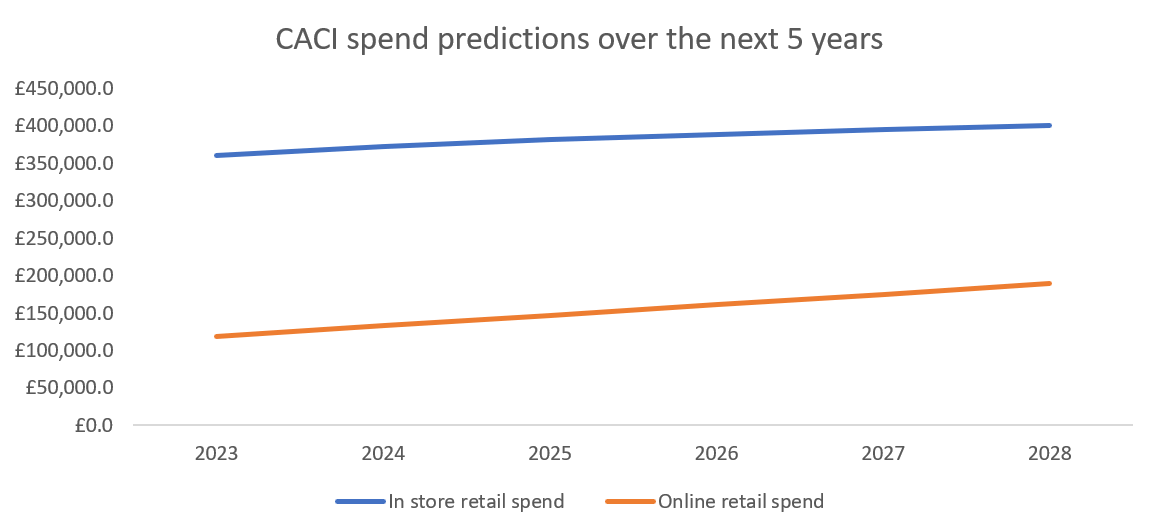

Whilst 2022 did represent a return to bricks and mortar, we are still at least a year ahead of where we would have been if the pandemic hadn’t happened. We expect to see continued growth in both on and offline retail spend, although proportionally online spend will increase.

However, it is undoubtedly true that we are currently, and will continue to, experience unexpected macroeconomic challenges which will impact different brands and destinations in different ways. Brands can no longer rely on their name as we have seen with the casualties of too many well-known landlords and retailers. Therefore, making informed decisions through the use of CACI data will help retain a competitive advantage and stand out from the market.

To learn more about how CACI can help your brand navigate changing consumer spending habits, get in touch with us here.