Understanding EV Demand

The steady growth in sales of Electric Vehicles (EVs) has been one of the few good news stories in the UK New Car market over recent months.

Almost all the major manufacturers have at least one EV model or are bringing one to market at some point in the next 12-to-24 months. But despite Battery Electric Vehicles (BEVs) being regarded by many as the only future for sustainable mobility solutions and the much-publicised Government target for zero emissions by 2040, the market is still comparatively small.

The Society of Motor Manufacturers and Traders figures show Battery and Plug-in Hybrids account for 2.7% of the 2019 New Car market to date and in total BEVs still account for less than 1% of all cars on the road.

And this presents an interesting challenge for Automotive Network Managers and Product Planners – how do you understand geographical demand for your models in an embryonic and sporadic market? The “traditional” approach of following the market through TIV (total industry volume) can’t be reliable when the volumes are still so low.

It stands to reason that demand for EVs will be determined by three main factors and each of these will vary geographically:

- Consumer demand – who is likely to want to buy an EV?

- Accessibility – how easy is it to own and operate an EV?

- Wider “Push Factors” – external initiatives to increase awareness, consideration and ultimately purchase of EVs

At CACI we think that taking a data-driven and largely customer-centric approach to these questions can help the industry understand how and where to effectively target EV opportunity.

Consumer Demand

So who is buying EVs? In the early days of EV deployment it was often assumed that the younger urban sophisticates would lead the charge (no pun intended) for EV take-up. But there was always one glaring problem with this assumption – these people don’t buy cars!

Instead, anecdotal evidence suggested that EVs have been particularly popular with older rural customers. To some that might seem odd but if we think about it, it makes sense. These customer types are more likely to have lower mileage or infrequent usage patterns so any concerns about range become less relevant. The more affluent rural types will likely live in larger properties, so they have space for a private chargepoint. And research suggests that typically they are more likely to favour function over performance for their driving experience – although most EV models offer as good performance as their petrol/diesel counter-parts for many there is still a perception of a drop-off in this regard and for some types that can be an important factor in the consideration to purchase.

Of course, this isn’t to say that all EV customers are older rural types – far from it – but it is an example of how we need to think harder about the different motivations and characteristics of an EV customer and how this can help us understand demand.

Consumer Characteristics

So what are the likely consumer characteristics and motivations? I would say the top 3 are:

- Higher disposable income (the price-point of EVs is higher than their petrol/diesel equivalent)

- Lower annual mileage or likelihood to own two or more cars (so EV can be the second or even third “run-around” car)

- Increased awareness of environmental issues and a desire to reduce environmental impact

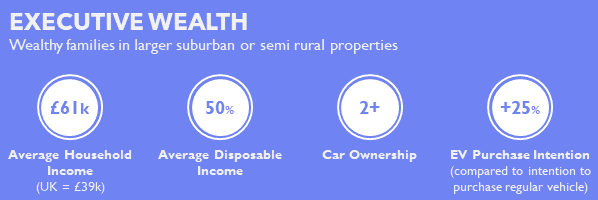

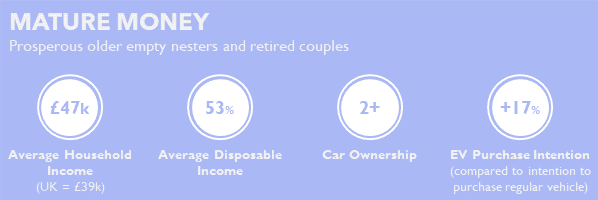

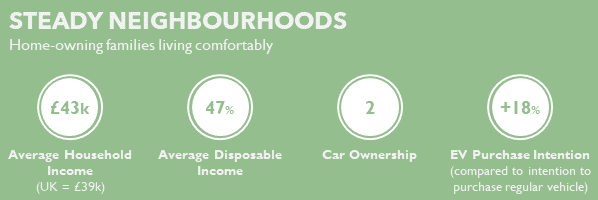

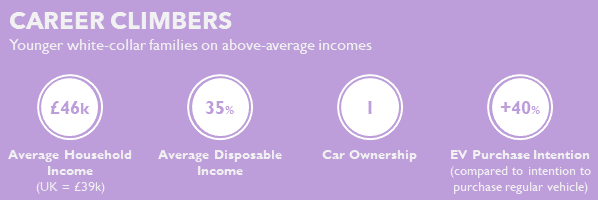

CACI’s research using Acorn and Kantar’s Target Group Index (TGI) shows those who have purchased or are considering purchasing, have many of these distinct characteristics, not least the prevalence among the more affluent Groups, particularly the older ones (Executive Wealth, Mature Money, Steady Neighbourhoods) but also the younger ones too (especially Career Climbers).

What is Acorn?

Acorn is a geodemographic segmentation of the UK’s population. It segments postcodes into 6 key categories, 18 groups and 62 types. By analysing significant social factors and population behaviour, it provides precise information and an in-depth understanding of different types of people.

Panel research data can be used to identify consumer groups most likely to want to purchase an EV. Acorn can then be used to link this “purchase intention” to the UK population to quantify demand and also geographically target specific local markets. This answers the critical questions of: Who? How many? And Where?.

But understanding the profile of a “typical EV customer” will only get us half the way. Already, there is likely to be a difference between those who go for the more aspirational models such as Tesla, Mercedes EQC or Jaguar I-PACE and those who want the more affordable models such as Nissan’s Leaf, VW’s E-Golf or MG’s ZS EV. And the profile will change further as more and more models come to market at all levels of the price-point spectrum.

The great thing about the customer-centric approach is it can be tailored according to the model. By understanding which Acorn Types are most likely to take-up a specific EV, the size of the demand (and how best to reach them) can be established.

Below are 4 example Acorn groups classifications and their EV profiles:

Still, even after accounting for this, arguably it is just one side of the equation…

Accessibility

The motivation and means to purchase an EV is only one factor. The ability to own and operate one is also crucial and this leads to the critical question of charging. Most surveys of customers find that concerns about range are top of the list of factors that might dissuade from purchasing an EV. Some manufacturers have taken innovative steps to help customers get over this hurdle, such as Mercedes’ “EQ Ready” App which tracks your driving behaviour and tells you how much charge you would have left at the end of the day if you were in an EV. But nevertheless, access to chargepoints will be seen by many as a crucial factor in their decision to purchase.

Public chargepoints are becoming more and more available but their distribution does vary considerably. Measuring the provision of public chargepoints in an area is becoming easier as more data becomes available, some free to use (such as the National Chargepoint Registry or openchargemap.org), others on an annual license (such as ZapMap). And they reveal some interesting patterns in the provision of chargepoints. For instance, using NCR we can see that three of the Top 10 Local Authority Districts by number of chargepoints are in the North East.

But again, measuring public chargepoint accessibility in an area is only one part of the equation. Almost all EV owners will want to have private charging facilities at their own property. Very few would savour having to run a charging lead out of their front door or living room window onto the street. So while there are schemes, such as in Brighton, to provide chargepoints in lamp posts for those without, for the majority it is safe to assume that private off-street parking is an essential requisite.

No comprehensive dataset of private chargepoints exists yet, but there are ways we can measure how many properties have the capability to install one. The simplest of these would be to assume that a certain proportion of semi-detached and detached properties would have a drive-way and then use Land Registry data to quantify those, further narrowing it down by their freehold status. And a blended data approach could be taken to overlay the number of private vs rental properties (although some landlords might see having a chargepoint as an attraction in a crowded market).

A more sophisticated (and therefore expensive) approach would be to use GIS data to identify individual property footprints that are a sufficient distance from the road to indicate a driveway (or garage) and therefore space to install a chargepoint. One can also imagine satellite imagery and remote-sensing techniques being used to good effect here (albeit at a cost that might outweigh the benefit of the accuracy).

It is true that both these approaches will miss some things, for instance shared chargepoints in private parking for flats, but they still provide a good “all things being equal” measure of capacity.

Perhaps the most exciting developments will be with the employment of AI and machine learning to utilise resources such as Google StreetView to “spot” chargepoints and quantify. One can imagine many applications for this outside of the Automotive industry (again where the benefit might outweigh the cost).

And this data-driven approach can be future-proofed too. The Government is considering policy to make every new residential property with an associated parking space be fitted with a chargepoint. If that comes into effect then datasets that describe the level of new-build housing development in an area will be key in showing how demand for EV might change over time.

External Push Factors

The final piece of the puzzle here is the external factors that may encourage people to adopt an EV. Local initiatives (often led by Local Government) are key here. Many cities are rolling out schemes such as ultra-low emission zones (ULEZ) that restrict usage of certain types of vehicle and that might prove the push that some people need to adopt an EV. It will be instructive for Automotive planners to keep an eye on which cities will follow the lead of London, Bristol or Birmingham (to name but three) to see where EV demand could spike next. But it would also be wise to see what else is in play. Complementary schemes such as car-sharing, park and ride or cycle-to-work schemes might provide alternatives that might deter the take-up of EV in that area as people feel they can reduce their carbon footprint in other ways.

But with the “stick” to push people away from their current vehicles there also needs to be the “carrot” to help them adopt the alternatives. The Government grants for EV have already been cut once and any further reduction might see a substantial drop-off in the more price-conscious consumer types that might otherwise have considered an EV. Will they instead look for a cheaper used or nearly-new post Europe 6 Diesel or Euro 4 Petrol model (which are exempt in some clean air schemes) or downsize to a model with a lower emission rate? The impacts of these schemes could be felt in other areas of the Automotive industry, rather than just the take-up of EV, so again a geographical consumer-driven perspective is essential.

Understanding EV Demand

We have explored just a few areas in the multi-faceted world of Electric Vehicles. There are still some considerable hurdles to cross in terms of both public perception and infrastructure challenges before they reach the levels of ubiquity that are envisioned by some long-term forecasts. Until that point is reached the take-up of these vehicles will be driven by demand and supply.

At CACI we contend that a consumer-centric approach driven through data products such as Acorn, blended with other complementary datasets provides the means to estimate and quantify where Automotive manufacturers can best achieve success in this field. To find out how we can help you, get in touch.