Nestlé’s sales operation in the Oceania region encompasses Australia, New Zealand, and the Pacific Islands. Nestlé Oceania employs more than 5,000 people in over 70 offices, factories and distribution centres strategically located across the region, promoting and distributing brands including many household names, such as Nescafé, Nesquik, Milo, Maggi, Carnation, Kit Kat, Aero, Smarties and Soothers.

The Challenge

It had been many years since a comprehensive review was performed on Nestlé’s field operations, and they were keen to ensure that it was run in a more efficient manner.

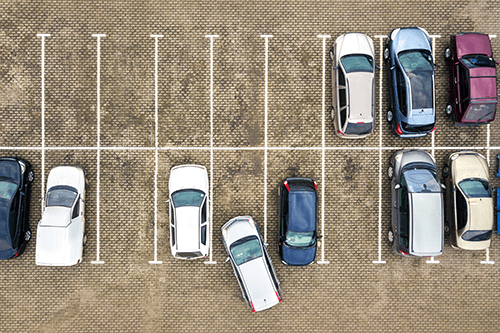

Nestlé also wanted to understand what the best service model looked like through a bottom-up build of the work required to be undertaken, ensuring the right resources were delivered to the right stores at the right time. The aim was to arrive at a final strategic solution that delivered great service for Nestlé’s customers, but in a way that ensured that sales reps were given challenging, achievable workloads and also spending considerably less time stuck behind the wheel of a car. As a respected corporation, with a stated commitment to environmental sustainability, minimising the environmental impact of the salesforce was also of great importance.

The Solution

Nestlé Australia, worked with the team at CACI, initially on a consultancy basis, to perform two major pieces of work.

The first was to create the ideal territories for the sales team, determined by various sets of criteria. This was not just about benefitting from the sophisticated optimisation algorithms within CACI’s headcount analysis and territory optimisation software, InSite FieldForce, but also then engaging in interactive workshops with CACI’s experienced consultants to achieve a final solution that was efficient, but also addressed the challenges of some important business considerations.

Once the territories had been identified, CACI’s routing software, CallSmart, was then utilised to develop the most efficient routes to service the stores.

Nestlé were impressed by the speed and efficacy of the CACI solutions and team of experienced analysts. Knowing that their market was always prone to change, Nestlé took a decision to license the software to ensure they could maintain the level of efficiencies gained in the initial phase.

I had the opportunity of working closely with the team at CACI on a large project that lasted over six months. We relied heavily on the software to provide facts and insight into how we should set up our supermarket field team most efficiently. The results have been extremely positive, highlighting how we can do more with less when we operate a lean and efficient team. With the expertise that we have developed, we are now using the software together with what we learned through the project to drive further efficiencies through our non-grocery business.

Ross Stephenson – Project Manager, Nestle

The Results

Through a combination of the software and consultancy support from CACI, during both the initial project and ongoing use of the licence, Nestlé were able to rework their territories to give field staff:

- More productive time in store

- Less unproductive time in the car

- Territories that were closer to home

Subsequently, Nestlé has been able to significantly reduce its carbon footprint, through a large reduction in the kilometres travelled by the field team. Nestlé estimate this to be around 1.7 million kilometres less per year, which equates to roughly 42 laps of the world, or 90 million party balloons less CO2 being emitted.

Further Information

If you want to hear more about how CACI’s field force expertise can help you and your team, get in contact now. We have a range of solutions that can help you optimise your field force.