Summary

Handelsbanken are a major Swedish bank; their central proposition is they are a ‘relationship bank’ offering a truly personal service. Each branch operates as a local business, with an in-depth understanding of the local market and community; services tailored to each client’s needs.

Handelsbanken had always focused on delivering excellent experiences and services. However, when the Financial Conduct Authority (FCA) announced a new Consumer Duty was due to come into force, this was a catalyst for Handelsbanken to implement a formal, structured user and customer experience analysis and action plan.

Company size

10,000+

Industry

Finance

Services used

Challenge

The Consumer Duty requires financial firms to ensure customers receive helpful and accessible customer support, clear information, and products and services that meet their needs and offer fair value. Firms must proactively protect customers from harm and ensure customers in a vulnerable situation, such as financial difficulty or during life events like bereavement, are not disadvantaged or put at risk. Firms must also identify and tackle pain points causing customers harm.

Handelsbanken’s challenge was to ensure they could meet – and evidence – their new regulatory requirements. This requires a culture of customer research, a workforce empowered to achieve the bank’s customer-centred objectives, and toolkits and governance systems in place so stakeholders in the independent branches can work to consistent standards, creating cohesive customer experiences across all channels.

With our experience in Service Design, governance, and training, we were chosen to create a new scalable customer journey framework and embed a customer-centred approach into the existing ‘Handelsbanken Way’.

Solution

From the beginning, we worked closely with Handelsbanken’s internal teams to create a detailed working process and roadmap, using business analyst insights into operational processes in branches to inform our work.

We undertook extensive quantitative and qualitative research with a diverse range of Handelsbanken team members and customers. Due to Handelsbanken’s unique decentralised model, we needed to approach customer journey and pain point mapping from both a branch and customer perspective.

In addition to our usual definition, creation and validation of customer persona groups, to meet the Consumer Duty guidelines we also created 5 vulnerability lenses, that could overlay any customer persona and journey, to identify and trigger the appropriate support and sensitivity for a customer’s circumstances, whether in the case of ill health, fraud or financial difficulty, for example.

A critical part of our work was supporting Handelsbanken’s team with the tools and culture to deliver this new customer journey approach in practice. We developed the concept of a review panel with senior stakeholders, to create a pain point prioritisation roadmap and took outcomes into ideation and put into action quick wins ahead of the Consumer Duty July 31st 2023 deadline.

Results

We analysed the bank’s 54 services and products and identified 99 customer journeys as being in the scope of Consumer Duty. We uncovered 375 pain points for customers, of which 128 were classified as having potential to cause customer harm; running ideation sessions to establish solutions for the 128 priority areas to address.

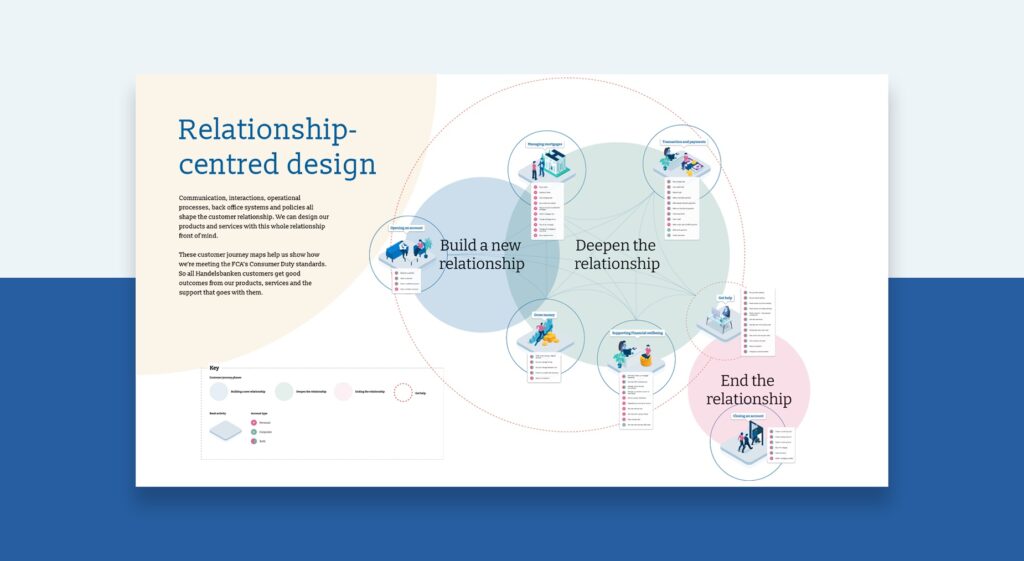

This was mapped and visualised into a structured framework that will deepen Handelsbanken’s relationship with customers from the day they come on board, right through to ending the relationship – as well as be used to evidence and ensure compliance towards the Consumer Duty.

The insights gathered throughout this process were methodically and transparently documented and collated into a detailed digital knowledge base including context and guidance, how-to guides, templates, case studies, artefacts, and much more. Providing the foundation for ongoing continuous improvement and internal work.

We worked collaboratively with people across the bank, developing a cross-bank operating methodology and providing staff training around customer-centred design. All of this helping to embed the framework and Consumer Duty compliance into Handelsbanken business-as-usual.