Summary

Cabot Financial is a group of leading credit management service organisations. They cover several services, including debt purchasing and business process outsourcing. We’d previously worked with debt recovery firm dlc to deliver their multiple award-winning mydlc platform, which helped customers to resolve debt in the best way for them at what can be a difficult time.

So, when Cabot acquired dlc, they chose CACI as their partner to kickstart their own digital transformation and growth in the debt management space. A relationship which started in 2015 and continues until today.

Company size

1000+

Industry

Financial Services

Challenge

As an ambitious company looking to grow the scope of its credit management services in multiple markets, Cabot needed digital ecosystem that was highly user-centric, able to scale with its business aspirations over time and be continually compliant with relevant industry bodies, such as the Financial Conduct Authority.

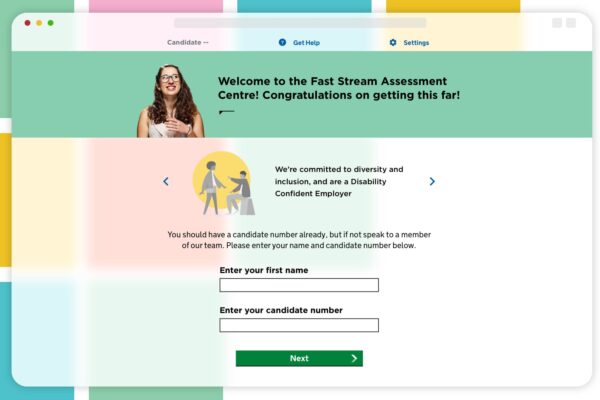

This required a deeply empathic user-centred design approach to define and establish a solid architecture and scalable, fully integrated digital platform that could meet both back-office requirements and support vulnerable users in what is often a highly stressful situation.

Solution

The project began with in-depth quantitative and qualitative user research. As Cabot’s users are often vulnerable and under financial stress, understanding their needs was essential. These insights shaped user journeys, information architecture, and features—ensuring users could easily find information, complete tasks, and manage their finances.

We chose Laravel for its flexibility and scalability to build a user-friendly website and native mobile app. These included e-commerce features, a customer portal with integrated payment gateway, and a restructured system architecture. Using Agile methodologies, we moved from Alpha to Beta and launched a live MVP in just six weeks.

The Laravel application integrated seamlessly with Cabot’s back-office systems via REST APIs, Opayo for payments, and third-party services like Salesforce. To support 24/7 operations, we implemented robust hosting practices and managed DevOps pipelines for continuous updates and performance improvements.

We later migrated the platform to Microsoft Azure, enhancing security, efficiency, and cost-effectiveness. Over time, we scaled the application with features like TouchID login, online statements, and self-service tools—empowering users to manage their accounts independently.

Laravel’s architecture has enabled multi-brand deployment, sharing core business logic while allowing custom design and features tailored to specific user and market needs.

Results

The initial platform demonstrated success very quickly:20,000 customers signed up within the first 12 months and the work received multiple awards recognition including Best Use of Technology with The Drum’s Agency Business Awards. More than 1 million customers have now been helped on the digital platform and the application has been white labelled and rolled out four other brands across multiple countries.

We are still actively supporting the Cabot team with ongoing roadmap development to provide their customers with yet more self-service features and scale and increase the efficiency of the platform. All the while continuing to act as their digital transformation and lead Laravel partner helping them support the ever-changing needs of their vulnerable users and comply with the FCA’s Consumer Duty and other evolving regulatory challenges.