Financial Footprint defines and assesses the branch network performance of thousands of financial centres across the UK, enabling users to revitalise their network strategies and confidently invest in locations.

Struggling to optimise your branch network?

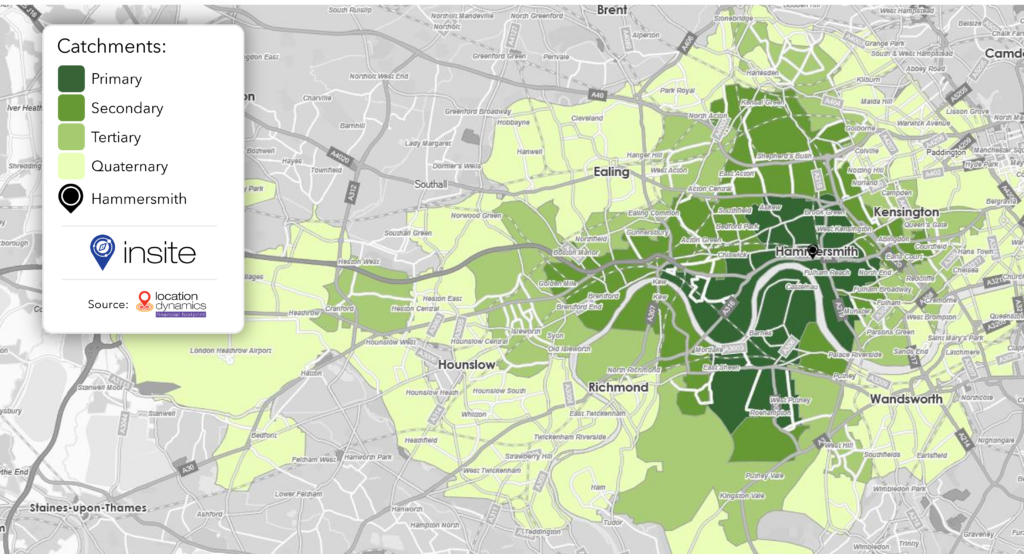

Describe who, what, where, when and why people interact with financial centres by understanding how your catchment interacts with that of a competitor.

Unable to gauge investment potential of UK finance centres?

This bespoke, fit-for-purpose and finance-specific model enables the review and assessment of investment potential of branch networks that exceeds the possibilities of a retail model.

Curating network strategies through refined branch performance assessment

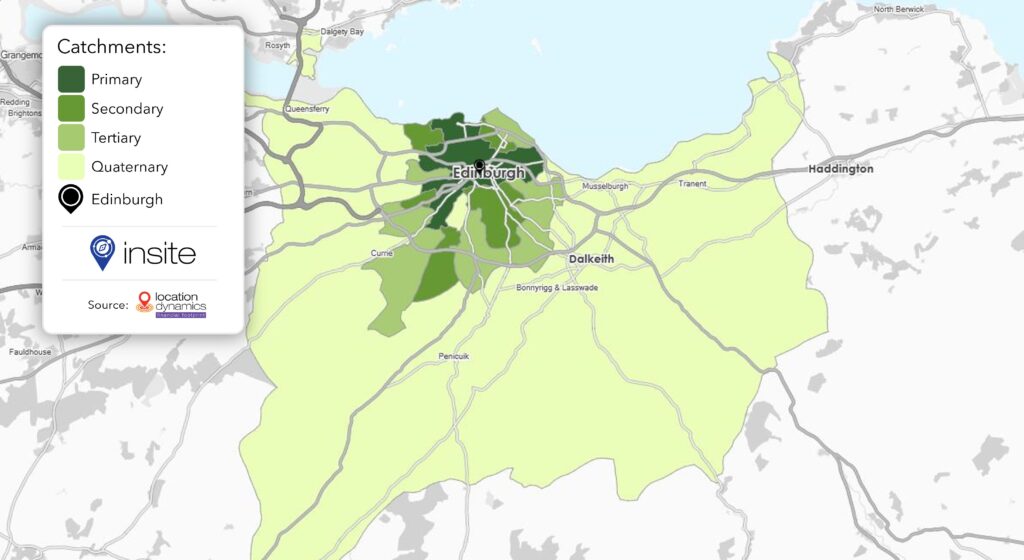

Financial Footprint is a financial catchment model that defines approximately 2,000 UK-wide centres. It delivers a robust, consistent framework for assessing branch network performance by allocating individuals and financial products to each centre to inform branch network strategies.

With more pressure than ever before to optimise branch performance, Financial Footprint is the most extensive financial centre catchment model available, built from clusters of branches that generate catchments using sophisticated AI and machine-learning techniques.

The model is innately granular, covering thousands of destinations. Any location with a single bank, building society or agent is included within.

Gauging investment potential by reviewing branch networks

Traditional retail-based models can be insufficient in the financial services sector due to the uniformity of branch distribution compared to retail supply. This insufficiency is what prompted the creation of Financial Footprint.

Developed from the requirement to review branch networks and understand investment potential, Financial Footprint is updated annually using the latest view of the banking sector across the UK, including an up-to-date snapshot of brands and branches, producing a solid framework for assessing branch networks.

Related datasets

Retail Footprint

Defining and ranking the opportunity for thousands of UK & European shopping destinations

Leisure Footprint

Defining and ranking the opportunity for thousands of leisure locations across the UK

Grocery Footprint

Assessing catchments and spend potential for grocery stores

Local Footprint

Insights for 38,000+ UK centres offering retail, leisure, convenience shopping and local services

Location Dynamics

A comprehensive location intelligence suite providing insights into the relationships between places and people

Fresco

The UK’s leading consumer finance classification, data profiling & marketing segmentation